On Friday, Pakistan’s government revealed the country’s fiscal year 2022-2023 budget. With a total expenditure of Rs9.502 trillion to stabilize the impoverished economy and alleviate the misery of persecuted groups, the proposal appears progressive. However, this budget has various consequences in several sectors, especially Pakistan’s real estate industry, with respect to new property tax policies.

What is tax and how the government utilizes it?

A tax is a compulsory financial charge or some other type of levy imposed upon a taxpayer (an individual or legal entity) by a governmental organization in order to fund various public expenditures. A failure to pay, along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent.

The purpose of taxation is to finance public expenditure. Government expenses include spending on goods and services that benefit society as a whole, such as national defense, infrastructure, and social security. The government also uses taxes to fund various assistance and transfer programs that help the less fortunate members of society.

In this blog post, we will talk about the expected taxes imposed by the Government on Real estate and how they will affect the industry and common people.

The government has proposed a number of changes in taxation policy for the real estate sector in its budget for the fiscal year 2022-23. These changes will have a significant impact on the industry, both in the short and long term. The most notable changes are discussed below:

Any questions, contact us on WhatsApp for a prompt response.

1. 1% Property Tax on Properties Worth More Than 25 Million Rupees

Anyone who owns a property worth more than Rs 25 Million or 2.5 Crore, it will be considered that your income is 5% rental income, and 1% tax will be levied against you according to the fair market value. However, the house, whatever its value, in which you are currently living, is exempt from this tax. This exemption is important because it ensures that people are not taxed on their primary residence. Without this exemption, many people would be unable to afford to keep their homes.

2. Advance tax

The new budget includes an increase in the tax rate for filers from 1% to 2%. Non-filers, who were currently subjected to a 2% penalty, will see their tax rate increased to 5%. This is to degrade non-filers and make it more difficult for them to remain outside the tax network. The hope is that by making it more difficult for non-filers, they will be forced to become registered filers. This may not be an easy task, as many non-filers are likely to find ways to avoid the increased penalties. However, if the government can succeed in getting more people to enter the tax network, it will be a major victory for tax reform.

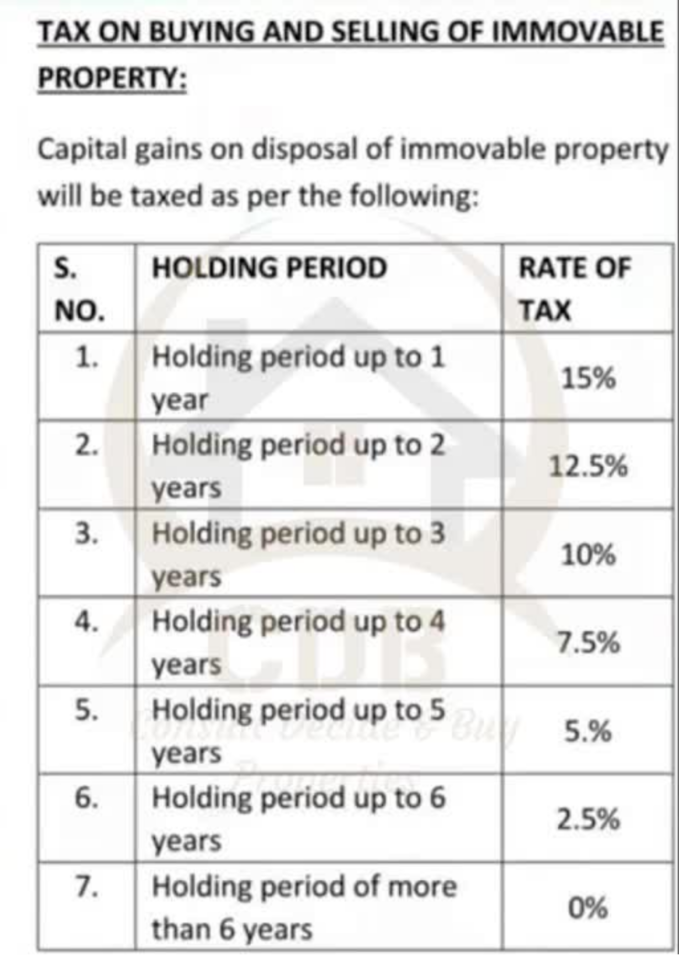

3. Capital Gains Tax

The current government has extended the period of time during which capital gains tax is not payable on a property from four years to six years. This will reduce the frequency of property transactions, as people will be more likely to hold onto their properties for longer. This is in order to encourage people to invest their money in productive areas rather than simply holding onto it in non-productive assets.

According to the new policy, If you hold the property for 1 year, the tax rate will be 15%. And every year, this tax rate will be reduced by 2.5%, which means you need to pay 12.5% tax after 2 years, 10% tax after 3 years, 7.5% tax after 4 years, 5% tax after 5 years, and 2.5% tax has to be paid after 6 years. And 0% tax if you own a property for more than 6 years.

If you don’t want to pay capital gains tax, you need to hold the property for more than 6 years. So, it is beneficial for those who are looking for a long-term investment.

Final Thoughts

These are some of the tax policies that are expected to be implemented by the government. Previously, when the same PML(N) government-imposed taxes in its last rein, we saw a big decline in the real estate market. The transactions were almost zero; investors were not taking much interest because they did not feel secure with the new tax policies.

These new policies have also caused some concern among investors in the country’s real estate market. While it is unclear what the exact impact of these taxes will be, it is possible that they could lead to a decline in transaction activity and investment in the sector. However, it is also worth noting that the real estate market in Pakistan has faced some challenges in recent years due to transparency and accountability issues. Therefore, it remains to be seen how these new taxes will impact the market in the long term.

Email: [email protected]

Contact : 03331115200

Contact : 03331115100

Any questions, contact us on WhatsApp for a prompt response.

Check out our Social Media pages for the newest updates of properties